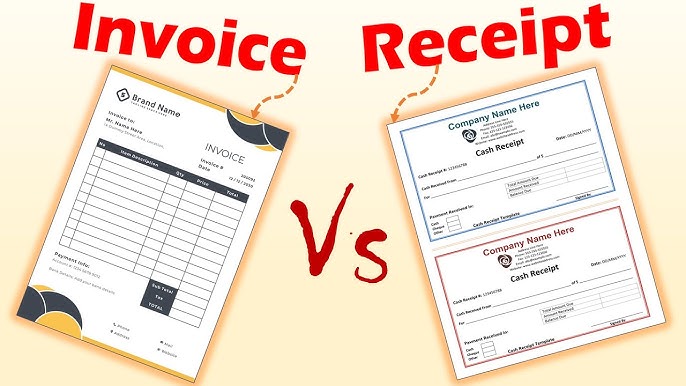

Sales Invoice vs. Official Receipt

If you run a business in the Philippines, understanding the distinction between a Sales Invoice vs. Official Receipt is crucial. These documents serve different purposes despite their similar functions. They play an important role in both tax compliance and business organization. Before issuing either document, ensure your business is registered with the Bureau of Internal Revenue (BIR) and has annual profits exceeding PHP250,000. If not, you’re tax-exempt and won’t need to worry about issuing these.

As your business grows, it becomes helpful to hire professionals who can handle legal paperwork. However, you don’t have to wait until then to grasp the basics. This guide will help you understand the key differences between sales invoices and official receipts, so you can avoid costly mistakes in your food or service-based business.

As your business grows, it becomes helpful to hire professionals who can handle legal paperwork. However, you don’t have to wait until then to grasp the basics. This guide will help you understand the key differences between sales invoices and official receipts, so you can avoid costly mistakes in your food or service-based business.

Sales Invoice vs. Official Receipt: The Key Difference

The main difference between sales invoices and official receipts lies in the nature of the sale. A sales invoice applies to the sale of goods or property. In contrast, an official receipt is issued for services or leases of property. Both documents serve as principal proof of transactions, which means they are essential when filing taxes. Supplementary documents such as billing invoices or purchase orders don’t hold the same weight for tax purposes.

The BIR clarified these distinctions in Memorandum Circular No. 002-14, emphasizing the need for strict compliance. This is important because you cannot substitute one document for the other. Each serves a specific role based on what is sold—goods or services. You can also refer to Section 237 of the National Internal Revenue Code for more details. It mandates that for every transaction valued at PHP25 or more, businesses must issue a receipt or a sales invoice. Although transactions below PHP25 are exempt, issuing a standard invoice can streamline bookkeeping.

When Should You Issue a Sales Invoice vs. an Official Receipt?

To decide which document to issue, consider whether your business sells goods or services. For example, if you run a grocery store, online shop, or specialty retailer, you’ll primarily be issuing sales invoices. In these businesses, once a customer checks out, they should receive an itemized sales invoice listing their purchases, regardless of the amount. Failing to provide one can lead to penalties imposed by the BIR.

On the other hand, service-based businesses like restaurants and catering companies should issue official receipts. These ventures offer a service beyond just selling goods. Even small transactions over PHP25 require an official receipt. While it may seem tedious for small purchases, issuing the correct document keeps you in compliance with tax regulations and ensures you avoid penalties.

Required Information for Sales Invoices vs. Official Receipts

Both documents must include specific details for them to be valid. The information required on an official receipt has evolved over time due to updates from the BIR. These updates address differences between manually issued receipts and those generated by machines or software.

For official receipts, the BIR has issued guidelines through various Revenue Memorandum Orders (RMO) and Revenue Regulations (RR). These outline the required information, which includes:

- The taxpayer’s registered name and business name

- Whether the taxpayer is VAT or Non-VAT registered

- The complete business address

- The date of the transaction

- A clear serial number on the receipt

- Buyer’s details (name, address, and TIN)

- Description of the service provided

- Quantity, unit cost, and total cost

- VAT amount (if applicable)

Machine-generated receipts must also include the Machine Identification Number (MIN) and the serial number of the cash register or POS system used.

Sales invoices, while simpler, also need specific details. According to RMO No. 12-2013, these include:

- Taxpayer’s registered name and business name

- VAT or Non-VAT registration and TIN

- Complete business address

- Date of transaction

- Serial number of the invoice

- Buyer’s details (name, address, and TIN)

- Description and quantity of the goods sold

- Unit cost and total cost

- VAT amount (if applicable)

In both cases, failure to provide the correct information can lead to penalties. Staying informed of BIR updates and local government regulations ensures compliance.

Now that you understand the difference between sales invoices and official receipts, you can decide what works best for your business. Sales invoices are for goods, while official receipts apply to services. Both serve as key evidence for tax filing, so issuing the correct document is essential. Always follow BIR guidelines and stay updated on any changes to avoid fines or penalties.

This Post Has 0 Comments