SME Loans

Business Financing for Entrepreneurs

Business Financing for Entrepreneurs

At Esquire Financing Inc., we recognize the significant role of small and medium enterprises (SMEs) in propelling the Philippine economy forward and making it one of the most vibrant in Southeast Asia. Our goal is to help the small and medium-sized business owners optimize their potential and achieve major growth through alternative sources of funding. Our advocacy is providing fast, hassle-free, and non-collateral business loans tailor fit to each entrepreneur’s needs, goals, and cash flows.

Since 2011, we’ve assisted more than 5,000 entrepreneurs – fueling their dreams of business growth through our loans. Our fulfillment lies in the fact that we are part of a bigger ecosystem: a trusted financing partner that helps Filipino entrepreneurs grow their business and at the same time, generate employment.

Our 3-step business loan does not require any collateral, has minimal application requirements and flexible and comfortable payment terms. What sets us apart is that our loan decisions are given within 7 business days, or less! This efficient and simple process is essential in understanding our clients and helping SMEs grow. Whatever your reasons are for availing a business loan, our SME business loan will fuel your dreams.

There is nothing more satisfying to us than watching our clients grow. Esquire Financing Inc. is here to help. At EFI, our business is your success.

Esquire Financing Inc. is an SME-lending company offering fast, hassle-free, non-collateral business loans tailor fit to the needs, goals, and cash flows of each small and medium-sized business owner.

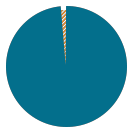

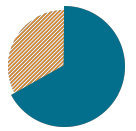

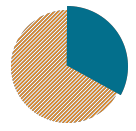

There are over 1 MILLION registered

businesses in the Philippines today

Of which, 99.6% are considered MSMEs

They employ 70% of the workforce

Yet, they have only attributed, 32% of the GDP

Only 20% get access to funding from

formal financing institutions

EFI is a direct response to the need of the underserved sector, we aim to make business loans accessible and convenient.

Our core advantage is providing non-collateral business loans in a timely manner based on cash flow analysis. We offer loan amounts between PHP 100,000 to PHP 10,000,000.

Our Advocacy

We recognize the difficulty entrepreneurs face when acquiring loans and saw the potential opportunity for a business that could be dedicated to helping local enterprises grow.

We took the time to understand what business owners really needed from a financing partner and this became the foundation of how we crafted our loan features: fast, hassle-free, and non-collateral. Ultimately, by advocating for SME growth through financing, we are helping in the advancement of a sector that can make the Philippine economy a driving force in Southeast Asia.

Our Company Cornerstones

Vision

To be a global leader in growth stage financing.

Mission

FUELING DREAMS of entrepreneurs by providing financial support and business advisory services to achieve success.

FUELING DREAMS of our team by fostering a family culture that empowers and inspires career growth.

“EFI” Values

Efficiency– We shall work as a team to promote an unparalleled customer experience.

Flexibility– We create possibilities through open communication.

Integrity– Trust and honesty are the pillars of our organization.

How our loans can help your business

Bridge FInancing

Delays in receivables and collections? Keep the business rolling with the help of a bridge loan.

Additional Working Capital

Improve the cash flow of your business. Strategically and efficiently use additional working capital to improve profitability.

Business Expansion

Take advantage of opportunities in the market by creating special projects, adding a new product line, recruiting more employees or even opening new branches.

Fill out an online loan form and wait for a call from our Loan Specialist

Complete application requirements and submit it to our main office

Claim your loans after 7 days

* fully approved applications with complete requirements

Minimal Documentation Requirements

Compulsory for all applications:

Duly filled-out and signed Application Form (Version – LAP.10.2017)

TIN ID and any other government-issued ID proof of the Principal Borrower

Latest three (3) months Bank Statement and Bank Certification

Photocopy of valid Mayor’s Permit

Photocopy of valid Barangay Business Clearance

2″ x 2″ ID picture of the Pricipal Borrower

Picture of the Business

1 Picture of Exterior – Picture of business premise from outside with sign board and its surroundings, and

1 Picture of Interior – Picture of business inventory

Latest (not older than 2 months) proof of billing for Business and Residence (e.g. electricity/water/cable etc.)

Sketch/map of Business and Residence location with nearest landmark

Additional requirements (photocopy of the following documents):

For Sole Proprietors:

DTI Certificate of Business Name Registration (original; and renewal, if any)

For Partnerships:

Business TIN ID proof (BIR Certificate of Registration)

SEC Certificate of Incorporation/Registration

Latest Articles of Partnership & By-Laws

Partners’ Resolution (EFI prescribed format: Version- PR.10.2017)

For Corporations:

Business TIN ID proof (BIR Certificate of Registration)

SEC Certificate of Incorporation/Registration

Latest Articles of Partnership & By-Laws

Latest General Information Sheet (GIS)

Secretary’s Certificate (EFI prescribed format: Version- SC.10.2017)

How do I apply for a loan?

There are 2 ways:

1. You may download the application form on this site, fill out the relevant fields, and submit it along with the necessary requirements to our main office.

2. You may request us to assign a Loan Specialist to assist you through the application process by filling out our online form.

What are the key conditions for a business loan?

Your business should have been operational for a minimum of one (1) year and you should have a checking account (CA) that has been active for at least six (6) months. See required documents here.

Is it possible to take out a loan without a checking account?

We only entertain clients who have an existing checking account because we receive our clients’ loan payments through post-dated checks (PDCs).

How long will it take for my application to be processed?

Processing takes up to 7 business days from the receipt of complete application documents.

How do I find out if my business loan application has been approved?

You will receive an email on the result of your application. In addition to that, an EFI Officer will contact you as soon as it has been approved!

How do I pay for my amortization?

Payment is done through submission of post-dated checks (PDCs) upon the release of the loan.

Can I take out a personal loan?

We are dedicated to helping local enterprises grow. As such, our business model and processes have not been developed to support personal loans.

What is your interest rate?

The interest rate is subject to the approval of the credit committee. The rate may vary depending on the loan amount as well as term length. We welcome interested applicants to submit an application and to sit down with us to discuss this further.

Fast, hassle-free non-collateral business loans for SMEs. Apply now!